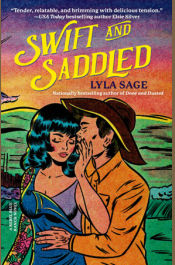

Indulge in a world of fantasy and romance with these books that offer the perfect combination of both.

Learn More

Indulge in a world of fantasy and romance with these books that offer the perfect combination of both.

Learn More

Recommended Right Now

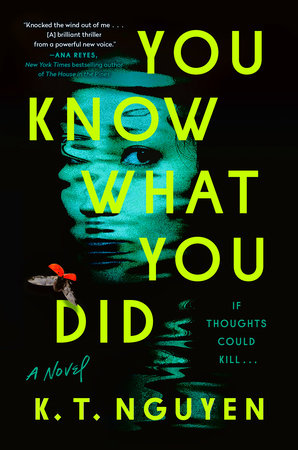

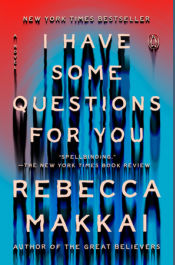

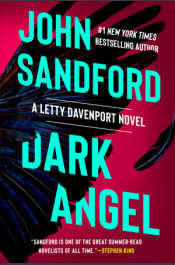

Books To Read if You Love “The Talented Mr. Ripley”

If you’re a fan of Patricia Highsmith’s simmering psychological suspense, we have a few recent favorites that definitely deserve a spot in your TBR pile.

See the list

Books To Read if You Love “The Talented Mr. Ripley”

If you’re a fan of Patricia Highsmith’s simmering psychological suspense, we have a few recent favorites that definitely deserve a spot in your TBR pile.

See the list